salt tax deduction limit

52 rows The SALT deduction allows you to deduct your payments for. In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the.

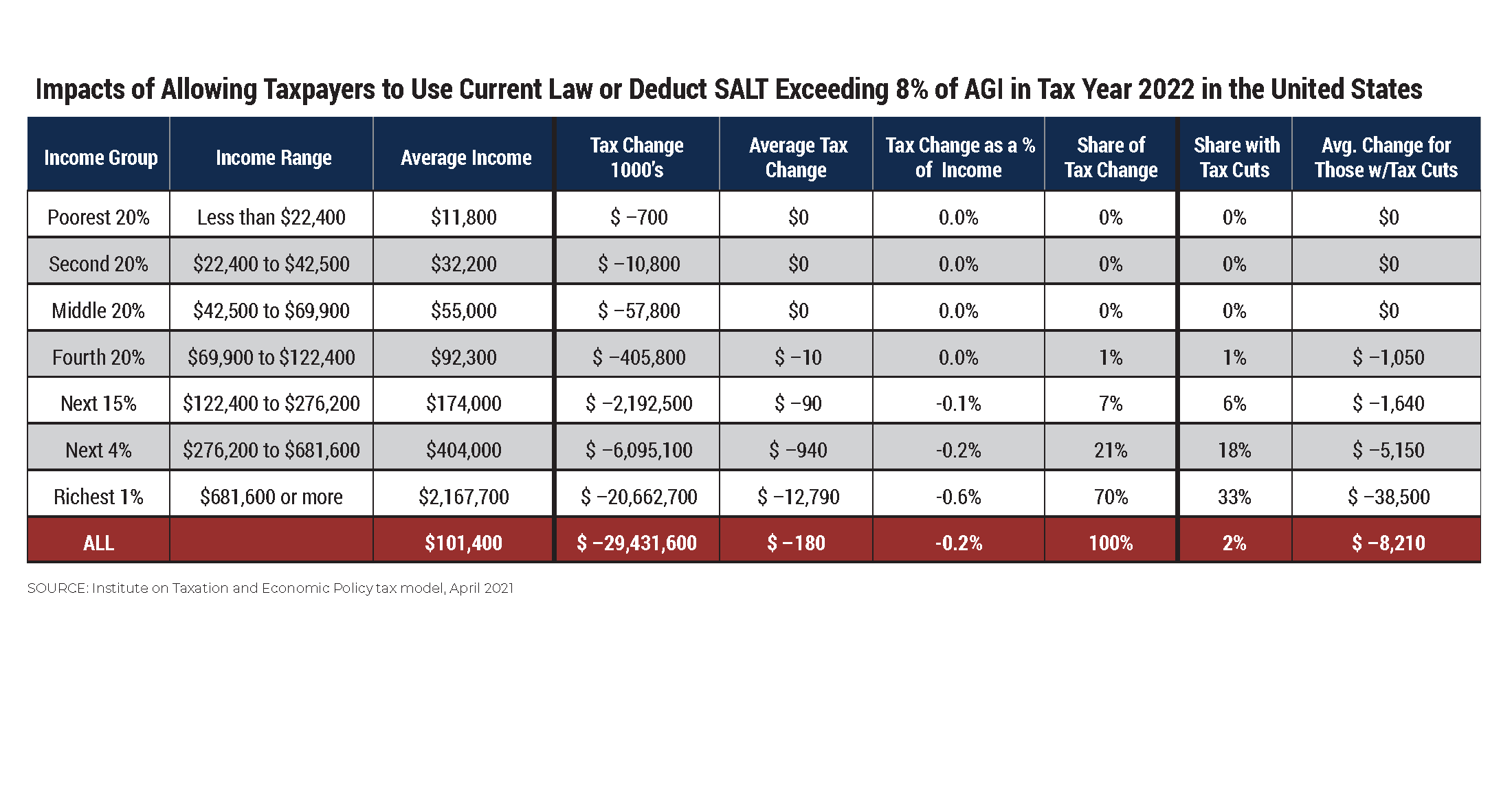

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Taxpayers who itemize may deduct up to 10000 of property sales or income taxes already paid to state and local governments.

. On November 9 the IRS released Notice 2020-75 announcing its plan to issue proposed regulations that many have been waiting for. New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their. But under the new rules while.

Before the TCJA there was no cap to the value of the. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes. The Tax Cuts and Jobs Act of 2017 changed a lot of things about the US.

The SALT deduction applies to property sales or income taxes already paid to state and local governments. Key Takeaways SALT refers to the state and local taxes associated with a federal income tax deduction for taxpayers that itemize their. Previously the deduction was.

While the federal standard deduction nearly doubled there. Maximum SALT Deduction. The law included a cap of 10000 not inflation adjusted for state and local taxes SALT such as state and local income and real property taxes.

Because of the limit however the taxpayers SALT deduction is only 10000. With a slim Democratic majority the 10000 limit was a sticking point in Build Back Better negotiations and House lawmakers in November passed an 80000 SALT cap. Second the 2017 law capped the SALT deduction at 10000 5000 if.

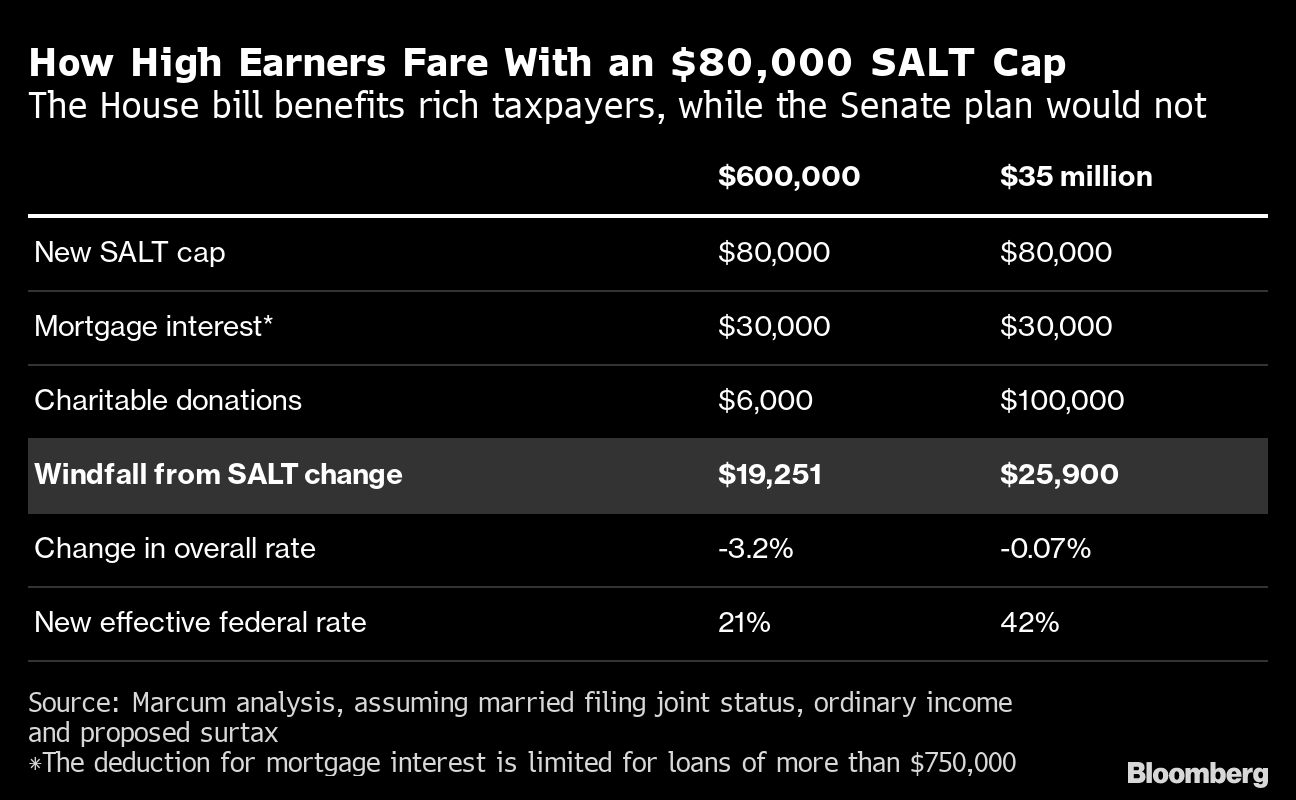

Community Property Considerations If you live in a state that recognizes. Lets break down how it impacts taxpayers who. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break.

Before the creation of a cap on this deduction 91 of the. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. Single and married taxpayers are limited to the same 10000 deduction.

Changes to the State and Local Tax SALT Deduction - Explained The new tax law caps the state and local tax deduction at 10000. 4 hours agoNow under current law a single filer in Californiawhere the top state tax rate is 133would exceed the SALT deduction cap after earning about 150000 180000 for a. For spouses that file separate tax returns the SALT deduction is limited to 5000 per person.

A 10000 ceiling on the previously. Your taxable income reported to the IRS would decline to 76000. The SALT deduction limit was part of a larger change to the individual income tax.

Filing status differences in. SALT Deduction Limit 2022 BBB Act New limits for SALT tax write off. SALT deduction limit background The Tax Cuts and Jobs Act of 2017 placed a 10000 cap on State and Local Tax SALT deductions.

But you must itemize in order to deduct state and local taxes on your federal income tax return. This deduction is a below-the-line tax. The 10000 limitation is the same for single.

Under the old rules you would be able to take a 24000 SALT deduction.

Unlock State Local Tax Deductions With A Salt Cap Workaround

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Pass Through Entity Tax Treatment Legislation Sweeping Across States Forvis

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Salt Deduction Limit Can You Get Around It American Academy Of Estate Planning Attorneys

State And Local Tax Salt Deduction What It Is How It Works Bankrate

Changes To Federal Salt Deduction Expose Illinois High Taxes

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Salt Cap Repeal Democrat Tax Plan Will Benefit Top Earners In High Cost Areas Bloomberg

Possible Federal Tax Law Changes On The Horizon

Democrats Reach Deal To Ease Salt Tax Deduction Cap

How Does The State And Local Tax Deduction Work Ramseysolutions Com

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction